Prediction for Loan Approval using Machine Learning Algorithm

Original price was: ₹6,500.00.₹5,500.00Current price is: ₹5,500.00.

| PROJ20158 |

Description

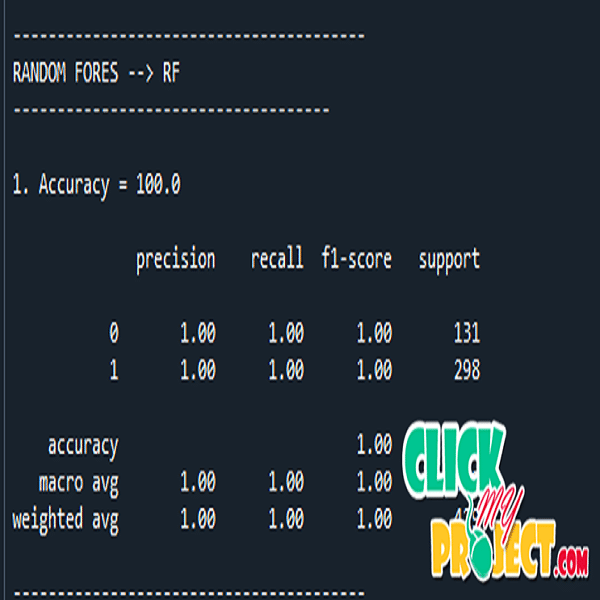

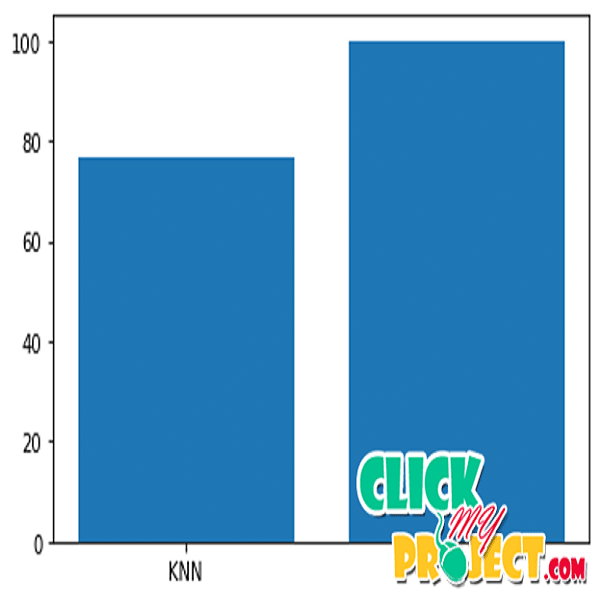

The loan status is used for creating a credit scoring model. Extending credit to individuals is essential for markets and society to act efficiently. Estimating the probability that an individual would default on their loan, is useful for banks to make a decision whether to approve a loan to the individual or not. In this paper, we find the accuracy of several models in R language and evaluate it to establish the finest model to forecast the finance status for an organization. We did the experiment five times on the same data set and find the experimental results that show the Tree Model for Genetic Algorithm is the best model for forecasting the finance for costumers. This system considers how automotive insurance providers incorporate machinery learning in their company, and explores how ML models can apply to insurance big data. We utilize various ML methods, such as random forest and KNN algorithm, to predict the loan status.