Description

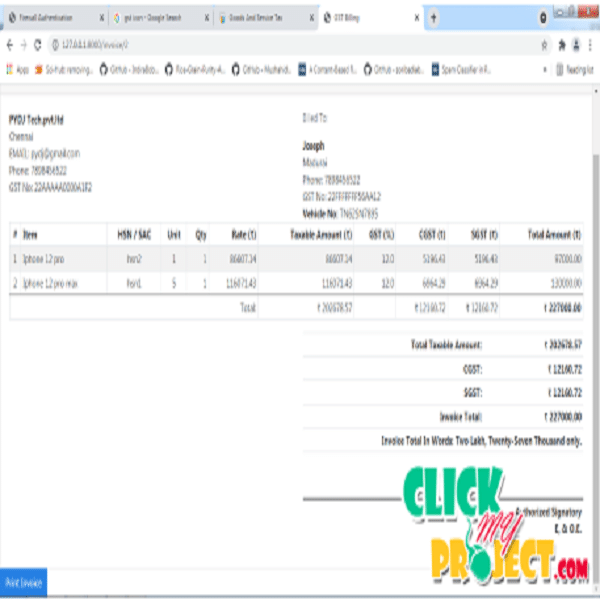

In this process is an analysis of what the impact of GST (Goods and Services Tax) will be on Tax Scenario. The Goods and Services Tax (GST) is a value added tax to be implemented, the decision on which is pending. GST is the only indirect tax that directly affects all sectors and sections of economy. The goods and services tax (GST) is aimed at creating a single, unified market that will benefit both corporate and the economy. The changed indirect tax system GST-Goods and service tax is planned to execute. Several countries implemented this tax system followed by France, the first country introduced GST. Goods and service tax is a new story of Value Added Tax (VAT), which gives a widespread setoff for input tax credit and subsuming many indirect taxes from state and national level. India is a centralized democratic and therefore the GST will be implemented parallel by the central and state governments as CGST and SGST respectively. The objective will be to maintain a commonality between the basic structure and design of the CGST, SGST and SGST.