Improved credit card churn prediction based on rough clustering and supervised learning techniques

₹3,500.00

10000 in stock

SupportDescription

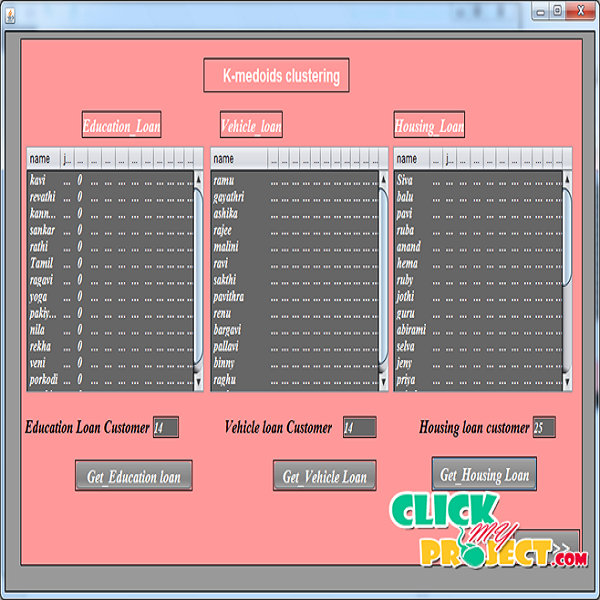

Every process is digitized in the current society. Transfer of money from one account holder to another has become possible in seconds because of advanced technologies in information processing. Not only this in all sectors like railways, insurance, health sector, fashion technology, education sector, sales and business sectors, and advertisement sectors every firm digitized its operations. One such sector is banking where every individual based on his or her financial status will be considered for crediting loan, and credit card etc. If the credit score of the loan availing person is high banks will be ready to provide him with the loan but the availing person can opt for any one of the banks on his or her own willing. Such scenario happens in credit card churn prediction also. Hence the banks should take healthy measures to retain the existing credit card holders without any churn. Withholding existing customers of a firm plays an important role to increase the overall revenue of the firm and retains the good name of the firm in competitive market. Hence every organization takes key measures to withhold existing customers using customer management models. Because customer retention is a crucial task as it reduces the time, money and workforce needed for adding new customers to the firm. Customers retention technique in credit card churn prediction (C3P) was done using only supervised classification techniques. But it could not end with better results. So, through many proven hybrid classification techniques we can bring better accuracy in C3P. Also C3P lags in highly efficient techniques like rough set theory. Hence in this work initially we perform data processing techniques and in second stage we propose modified rough K-means algorithm used for clus